Internal Rate of Return (IRR) is one of the most powerful metrics in investment analysis, but calculating it by hand can be challenging. This comprehensive guide will teach you everything you need to know about IRR calculation, from basic concepts to advanced techniques.

New to IRR? If you're unfamiliar with IRR concepts, start with our beginner's guide to understanding IRR first.

What is IRR? (IRR Formula)

The Internal Rate of Return (IRR) is defined by the following formula:

0 = CF0 + CF1(1+IRR)1 + CF2(1+IRR)2 + ... + CFn(1+IRR)n

Where: CF0 = Initial Investment, CFn = Cash Flows, IRR = Internal Rate of Return

This equation states that IRR is the discount rate that makes the Net Present Value (NPV) of all cash flows equal to zero.

In practical terms, IRR answers the question:

"What constant annual rate would make the present value of all future cash flows exactly equal to the initial investment?"

Because cash flows occur at different points in time, there is no direct algebraic solution for IRR. Instead, IRR must be solved iteratively, which is why most calculators and spreadsheets use numerical methods.

In the next sections, we will:

- break down each part of the IRR formula,

- explain why NPV must equal zero,

- and walk through a step-by-step manual IRR calculation example.

Ready to calculate? Jump to our IRR formula by hand step-by-step guide, or keep reading to understand the theory first.

The IRR Formula Explained

Let's build up the logic behind IRR step by step to understand why this formula works.

Simple Returns vs. Multiple Cash Flows

A simple investment is easy to evaluate: invest $1,000 today, receive $1,100 one year later, and the return is obviously 10%.

But what if cash flows are spread out? Consider investing $1,000 today and receiving $300 per year for 5 years (totaling $1,500). You can't just say "I made 50% return" — because when you receive money matters:

- $300 received in Year 1 can be reinvested immediately

- $300 received in Year 5 is "locked up" for 5 years

The Time Value of Money: Discounting

Money today is worth more than money tomorrow (due to inflation and opportunity cost). To compare cash flows fairly, we must convert future dollars into today's value — a process called discounting.

Example: If you can earn 10% annually, what's $300 received in Year 2 worth today?

Present Value = $300 ÷ (1.10)² = $300 ÷ 1.21 = $247.93

Net Present Value (NPV)

NPV is the sum of all cash flows (including the initial investment) converted to today's value:

NPV = Initial Investment + PV(CF₁) + PV(CF₂) + ... + PV(CFₙ)

- NPV > 0: The investment earns more than the discount rate

- NPV < 0: The investment earns less than the discount rate

- NPV = 0: The investment earns exactly the discount rate

The Key Insight: IRR Is Where NPV = 0

Here's the breakthrough: If we use the investment's actual annual return rate as the discount rate, then by definition, all future returns (discounted) will exactly equal the initial investment. That means NPV = 0.

So instead of asking "What's my return rate?", we flip the question:

"What discount rate makes NPV exactly zero? That rate IS the return rate!"

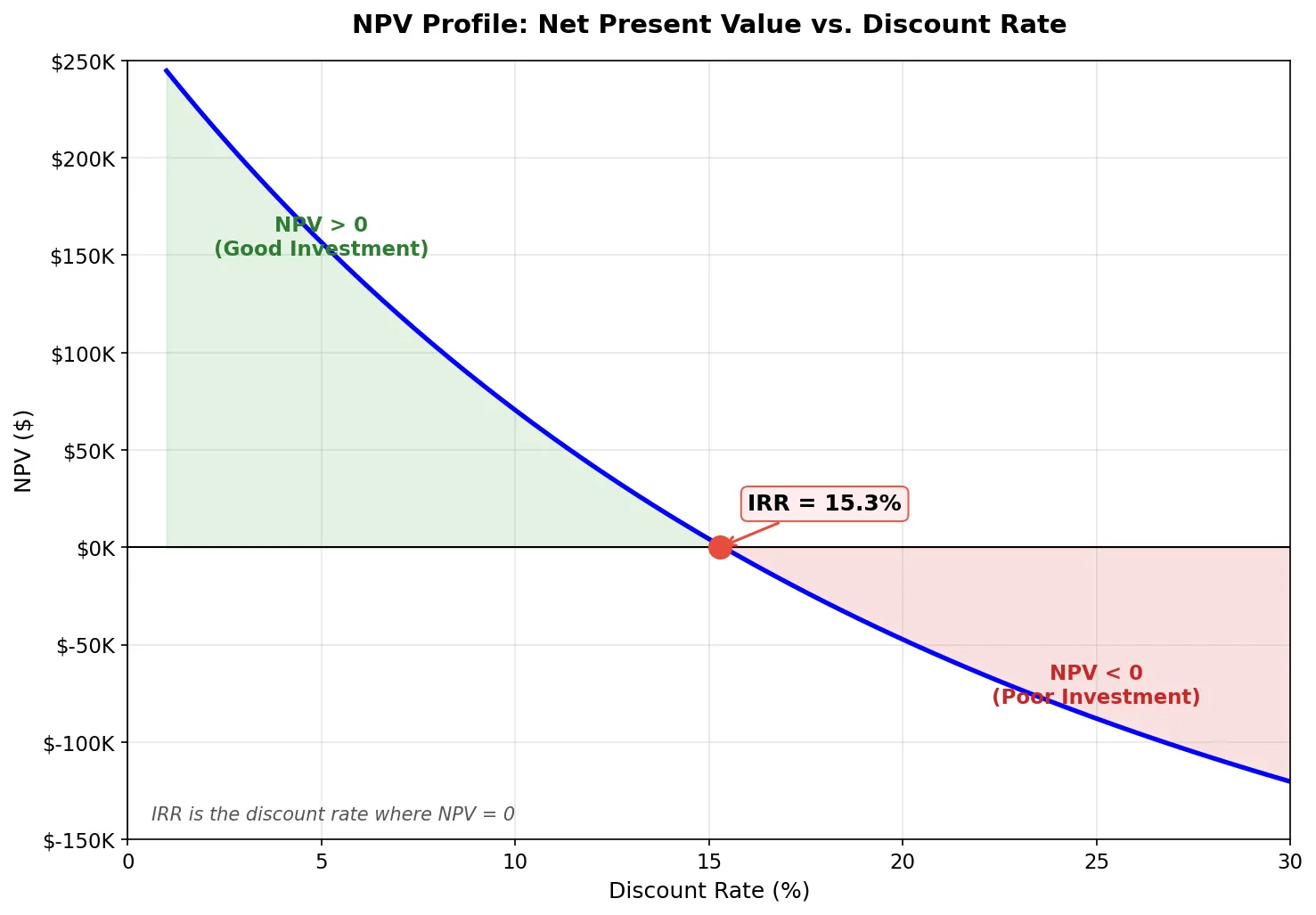

Visualizing the NPV Curve

As you change the discount rate, NPV changes predictably:

- Low discount rate → High NPV (future cash is valued highly)

- High discount rate → Low NPV (future cash is heavily discounted)

The curve crosses zero at exactly one point — that's your IRR. For the real estate example we'll calculate below, the IRR turns out to be approximately 15.3%.

Summary: The IRR formula isn't arbitrary. It emerges naturally from asking: "At what annual rate does the present value of all my returns equal my initial investment?" The mathematical answer is: find the rate where NPV = 0.

Step-by-Step IRR Calculation (IRR Formula by Hand)

Example: Real Estate Investment

Let's calculate the IRR for a rental property investment:

- Year 0: Purchase property for $300,000 (cash outflow: -$300,000)

- Years 1-5: Receive $24,000 annual rental income

- Year 5: Sell property for $450,000

Step 1: List All Cash Flows

Organize your cash flows by period:

- Year 0: -$300,000

- Year 1: $24,000

- Year 2: $24,000

- Year 3: $24,000

- Year 4: $24,000

- Year 5: $24,000 + $450,000 = $474,000

Step 2: Set Up the NPV Equation

We need to find the rate (IRR) that makes this equation equal zero:

0 = -300,000 + 24,000/(1+IRR)¹ + 24,000/(1+IRR)² + 24,000/(1+IRR)³ + 24,000/(1+IRR)⁴ + 474,000/(1+IRR)⁵

Step 3: Use Trial and Error or Newton-Raphson Method

Since there's no algebraic solution, we use iterative methods:

Trial 1: Try 10%

NPV = -300,000 + 24,000/1.1 + 24,000/1.1² + 24,000/1.1³ + 24,000/1.1⁴ + 474,000/1.1⁵

NPV = -300,000 + 21,818 + 19,835 + 18,032 + 16,393 + 294,253 = $70,331

Too high! We need a higher discount rate.

Trial 2: Try 15%

NPV = -300,000 + 20,870 + 18,148 + 15,781 + 13,722 + 235,701 = $4,222

Still positive, but closer!

Trial 3: Try 15.5%

NPV ≈ -$1,234

Slightly negative.

Interpolating between 15% and 15.5%:

IRR ≈ 15.3%

Step 4: Interpret the Result

An IRR of 15.3% means this investment yields an annualized return of 15.3%. If your required rate of return (hurdle rate) is lower than 15.3%, this is an attractive investment.

Common IRR Calculation Mistakes

- Forgetting the Negative Initial Investment: Your initial investment must be entered as a negative number because it's a cash outflow.

- Inconsistent Time Periods: If you're using monthly cash flows, your IRR will be a monthly rate. Convert to annual: Annual IRR = (1 + Monthly IRR)¹² - 1

- Multiple IRRs: Investments with alternating positive and negative cash flows can have multiple valid IRRs. Watch out for this with projects that require additional capital injections.

- Ignoring XIRR for Irregular Timing: If cash flows don't occur at regular intervals, use XIRR instead. Read our complete XIRR guide to learn more.

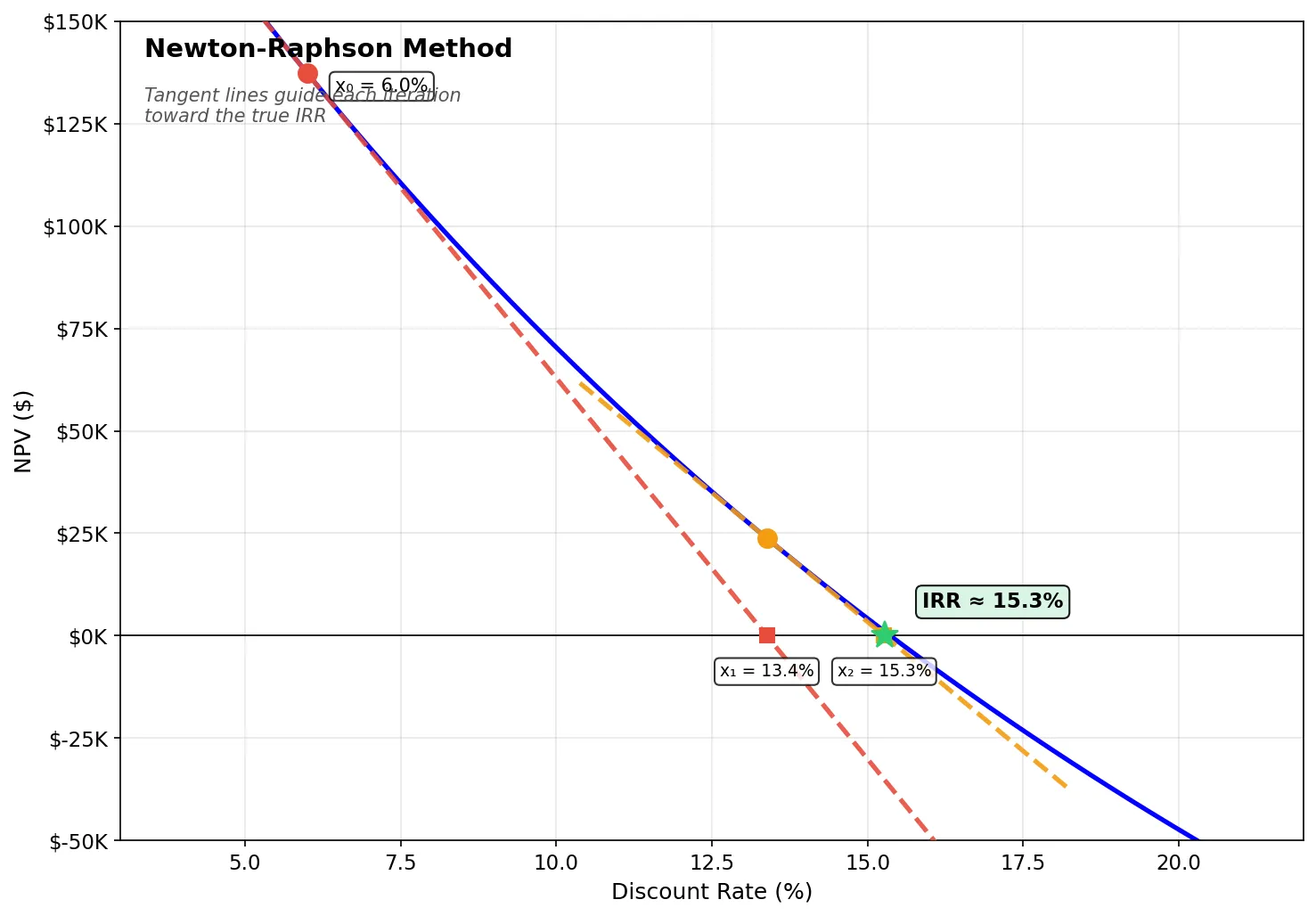

Advanced: How Excel Calculates IRR Instantly

You might wonder: how does Excel solve for IRR in a split second while manual trial-and-error takes minutes? The secret lies in a mathematical algorithm called the Newton-Raphson Method.

Instead of blindly guessing random percentages, Excel treats the NPV equation as a function curve and uses calculus (derivatives) to zero in on the exact answer.

The Newton-Raphson Formula

Excel solves for the root of the NPV function using this iteration formula:

xn+1 = xn - NPV(xn)NPV'(xn)

The Exact Steps:

- Initial Guess (x0): Start with an estimated rate (e.g., 10%).

- Calculate Derivative: Compute the slope (NPV') at that precise point.

- Update (x1): Plug x0 into the formula above to calculate x1, a more accurate rate.

- Iterate: Now plug x1 back into the same formula to get x2. Repeat this process (x2→x3→...) until the error is below 0.0000001%.

This combination of calculus and computing power allows Excel to find an exact IRR (like 15.3482%) in milliseconds.

Want to harness this power? Forget manual math. Download our Excel IRR Template to calculate it instantly using this exact algorithm.

Real-World Applications

PE firms target IRRs of 20-30%. They calculate IRR from initial investment through exit (sale or IPO) to measure fund performance.

Investors compare properties with different holding periods and rental income. Target IRRs: 12-20%. See our real estate IRR guide.

Companies evaluate capital projects. If IRR exceeds WACC (weighted average cost of capital), the project creates shareholder value.

VCs seek IRRs of 25-35%+ to compensate for high startup risk. They calculate from initial funding through acquisition or IPO.

Advanced IRR Techniques

Modified IRR (MIRR)

MIRR addresses some of IRR's limitations by assuming:

- Positive cash flows are reinvested at the cost of capital

- Negative cash flows are financed at the financing cost

This often gives a more realistic view of investment returns.

XIRR for Irregular Cash Flows

When cash flows don't occur at regular intervals, use XIRR (Extended IRR). Our calculator supports both:

- Regular IRR: Annual, quarterly, or monthly intervals

- XIRR: Any dates - perfect for real-world investments

Try our XIRR calculator → | Read the complete XIRR guide →

When NOT to Use IRR

IRR isn't always the best metric:

- Different Investment Sizes: A 50% IRR on $1,000 isn't better than a 20% IRR on $1,000,000

- Mutually Exclusive Projects: NPV is better for choosing between projects

- Non-Conventional Cash Flows: Multiple sign changes can produce multiple IRRs

- Very Long Time Horizons: Compounding assumptions may be unrealistic

Quick Reference Guide

IRR Benchmarks by Asset Class

- Public Equities: 8-12% (historical average)

- Private Equity: 20-30%

- Real Estate: 12-20%

- Venture Capital: 25-35%+

- Corporate Projects: Must exceed WACC (typically 7-12%)

- Bonds: 2-7% (varies with credit quality)

Conclusion

Calculating IRR may seem complex, but understanding it is essential for making informed investment decisions. While the math can be tedious, tools like our free IRR calculator make it instant and easy.

Remember these key takeaways:

- IRR measures the annualized return of an investment

- It accounts for the timing and amount of all cash flows

- Compare IRR against your required rate of return

- Use XIRR for irregular cash flow timing

- Complement IRR with NPV and ROI for complete analysis

Ready to Calculate Your IRR?

Use our free calculator with real-time examples and visualizations.

Calculate IRR Now →Frequently Asked Questions

What is a good IRR?

It depends on the asset class and risk. Generally, an IRR above 15% is considered good for most investments. Compare your IRR to benchmarks in your industry and your required rate of return.

Can IRR be negative?

Yes. A negative IRR means the investment loses money. This occurs when the sum of cash flows is less than the initial investment.

How is IRR different from interest rate?

IRR is the effective rate of return, while interest rate is usually the cost of borrowing. IRR is calculated backward from cash flows, while interest rates are predetermined.

What if my calculator shows "no solution"?

This happens when the equation has no positive real solution. Check that your initial investment is negative and you have positive future cash flows.

Should I use IRR or XIRR?

Use IRR for regularly-spaced cash flows (monthly, annually). Use XIRR when cash flows occur on irregular dates for more accuracy.